Medicare

The annual enrollment period for Medicare can be a source of either trepidation and confusion or assurance and confidence. With a little preparation and knowledge, you can gain the latter.

Medicare is complex, but if you break down its features into a few main categories, you will come up with an effective plan for purchasing coverage.

We will provide you with all the necessary information to compare and contrast your options, so that you can select the Medicare plan that best suits your needs.

To assess the right Medicare plan for you, it is essential to evaluate your medical insurance needs, existing coverage, budget, and preferred physicians and hospitals each year.

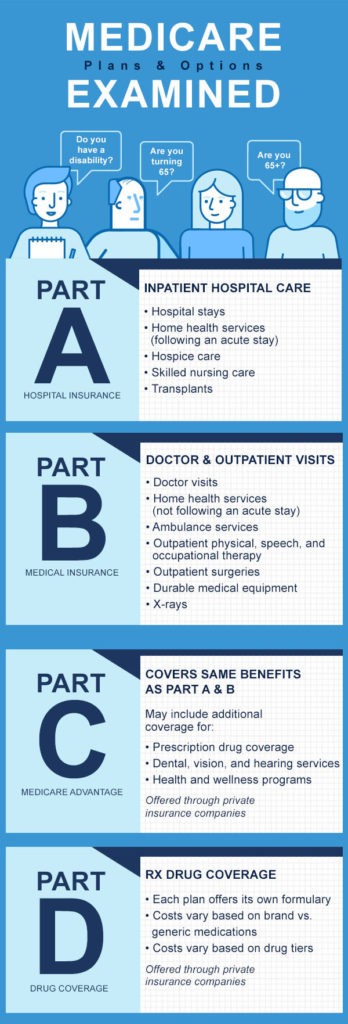

Part A covers inpatient care in hospitals or certain nursing facilities, and helps pay for hospice and home health care.

Part B covers doctor appointments, outpatient and home health care, as well as medical equipment and screenings.

Part C is a health plan offered through private companies that packages Parts A, B, and often D.

Part D covers prescription drugs and vaccinations, and is offered through private companies. With so many options available, it is important to carefully weigh your options to ensure you are receiving the best coverage for your needs.

When can you sign up?

At age 65, there is a seven-month period beginning three months prior to your birthday in which you can enroll in Medicare. Every fall, from mid-October through the first week of December, is the annual general enrollment period, where you can make changes to your Medicare plan.

Additionally, if you leave your job or move to an area not covered by your plan, special enrollment periods apply. It is important to note that if you receive Social Security benefits before turning 65, you will be automatically enrolled in Parts A and B of Medicare.

Medicare and You 2023 – Guide