Health

Are you eligible for low or no cost health insurance?

Are you paying too much or not getting all the benefits you should be getting?

Are you a business wanting to save costs on group coverage?

We understand that navigating the world of insurance can be overwhelming, with complex terms, regulations, and numerous plan options. That’s why we take the time to educate our customers, breaking down the information into simple and understandable terms.

Let’s explore a few compelling reasons why having a health plan is beneficial for everyone…

1. Affordable health insurance: Financial concerns often deter people from getting insured. However, financial assistance has made health insurance more accessible than ever before. Some individuals may qualify for premiums as low as $0 per month and even businesses now have opportunities to save big on group coverage.

2. Protection against catastrophic medical expenses: Even with a healthy lifestyle, accidents and unexpected illnesses can occur, leading to overwhelming medical bills. Without insurance, accumulating medical debt becomes a significant financial burden, potentially leading to bankruptcy.

3. Health insurance promotes wellness: In addition to financial protection, health insurance plays a vital role in maintaining good health.

4. Reduced out-of-pocket costs: Health insurance not only provides coverage after reaching the deductible but also offers savings on out-of-pocket expenses even before meeting the deductible.

Schedule a personalized session or explore options and self-enroll through our direct portal to the Marketplace. Let us guide you towards a healthier and more secure future.

It’s crucial to explore all the available options in your area to find the Medicare plan that suits your needs. To make an informed decision, you should evaluate your medical insurance requirements, current coverage, budget, and preferred healthcare providers and facilities on an annual basis.

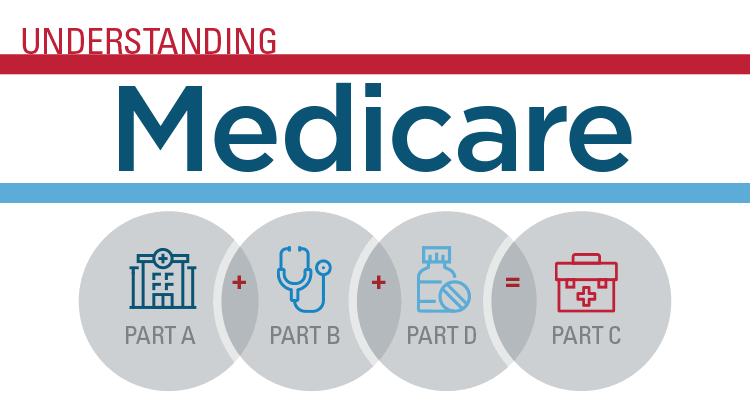

Medicare is divided into different parts:

- Part A: This covers inpatient care in hospitals or specific nursing facilities. It also helps pay for hospice care and home health care.

- Part B: This covers doctor appointments, outpatient services, home health care, medical equipment, and preventive screenings.

- Part C: Also known as Medicare Advantage, Part C is offered through private companies. It combines the coverage of Parts A, B, and often includes Part D (prescription drug coverage). Medicare Advantage plans may provide additional benefits beyond original Medicare, such as dental, vision, or hearing coverage.

- Part D: This focuses specifically on prescription drug coverage and vaccines. Part D plans are offered by private companies, allowing you to select the one that best meets your medication needs.

With numerous options available, it’s essential to carefully consider your choices to ensure you have the best coverage for your specific requirements.

To help you navigate through Medicare, we offer a free guide to Medicare 2024, this guide will provide valuable information and insights.

Additionally, you can schedule a free consultation with our experts who can help you explore the best options tailored to your needs.

Are you looking for alternative options to protect your health that could potentially be cheaper than traditional options?

If you’re in good health and don’t frequently use medical services, there are some plans you may consider. It’s important to note that these plans are suitable for individuals who primarily pay for medical services out of pocket and may result in lower overall costs. However, when choosing a plan with a low premium (monthly cost), it’s crucial to review the plan’s details and understand that the benefits might be less compared to more expensive plans.

Here are a few examples of off-exchange plans that are not qualified health plans (QHPs) and typically don’t comply with ACA requirements found on government marketplaces:

1. Short-term health insurance: This type of insurance provides temporary coverage for a limited period, usually up to 12 months. It may be a suitable option for individuals who need coverage during a gap in their insurance or for those who expect to have minimal healthcare needs.

2. Medical insurance packages (MIPs): These packages offer customized coverage for specific medical services or conditions, allowing you to choose the benefits that align with your needs. They can be a cost-effective solution if you require coverage for a specific set of services.

3. GAP insurance: GAP insurance, also known as supplemental insurance, helps cover the gaps in your primary insurance plan. It can be used to supplement your existing coverage and provide additional financial protection for certain medical expenses.

4. Critical illness insurance: This type of insurance pays a lump sum if you’re diagnosed with a critical illness specified in the policy. It can help cover costs not typically covered by traditional health insurance and provide financial support during challenging times.

5. Medical indemnity insurance: Medical indemnity plans provide you with a fixed cash benefit for covered medical services. You can use the cash benefit as you see fit, whether it’s for medical expenses or other related costs.

There are several benefits to consider when opting for an off-exchange health plan. Shopping outside the federally funded marketplace allows for a more personalized shopping experience. Since you’re buying directly from an insurance provider or broker, the agents are often more knowledgeable about available plans and can offer excellent customer support. This makes it easier for you to find an ideal plan that meets the needs of both yourself and your family.

Ready to Get Started?

For more information, or to obtain a free quote…

Call us today at 800-930-9880

As a full service brokerage, Lentini Insurance will help you:

- Shop the entire market for the right plan(s) for you, and provide you with premium quotes.

- Discuss alternatives with you so that you have a clear understanding of your plan choices.

- Implement the plan you select.

- Service your account, including solving problems with billing, eligibility and claims.

- Ease the burden on your time by doing the “legwork” for you.

- Assist you and your family at any time for years to come